8 tips on sending money from China with Wise

Here are our top tips and potential pitfalls when sending money from China* using Wise. This service is provided in partnership with a third party payment...

We are thrilled to announce that our customers in Japan can now open a multi-currency account to receive money for free.

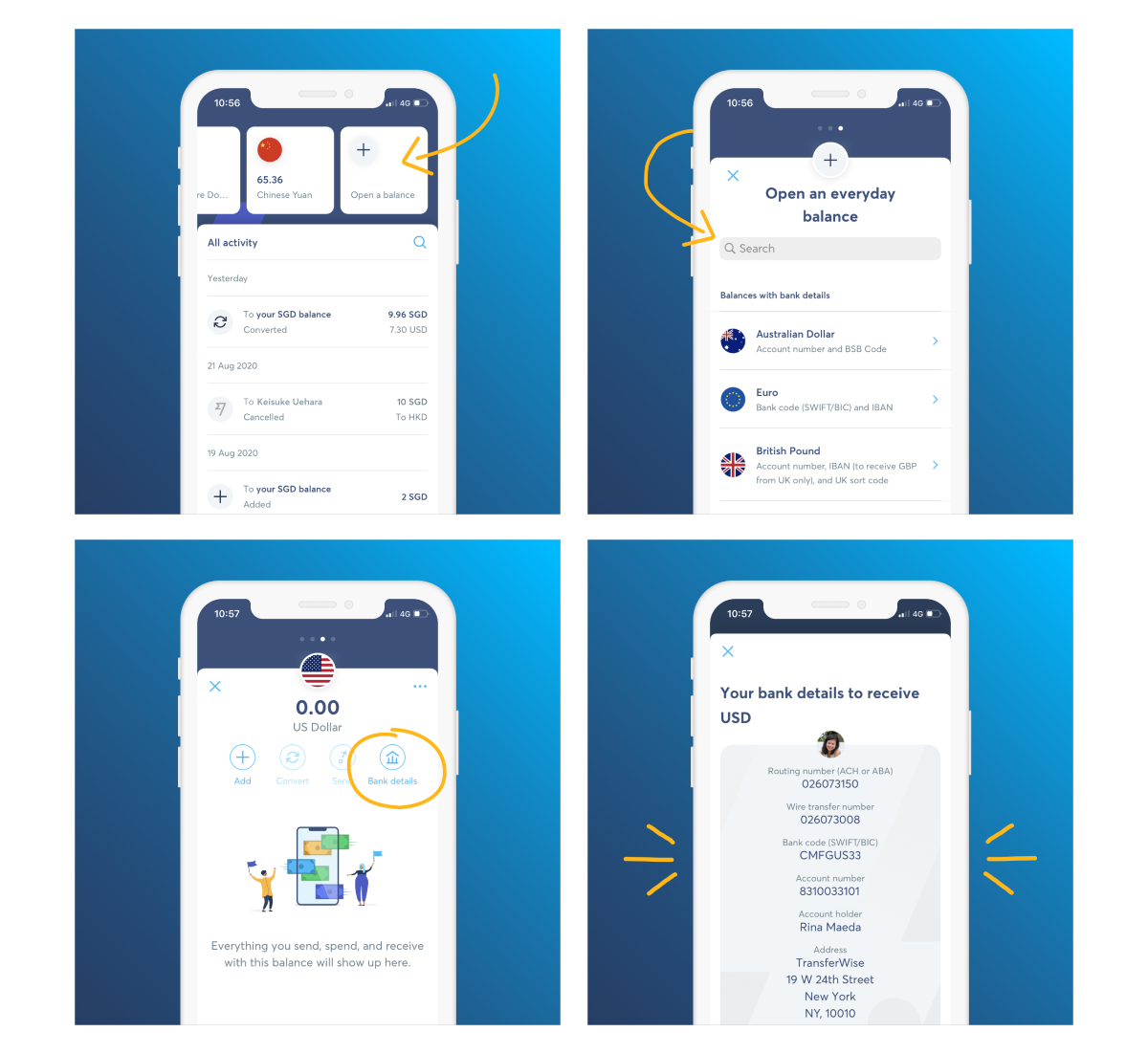

The Wise multi-currency account is designed for people living international lives. It lets you pay and get paid around the world. There are no hidden fees, and you no longer need bank accounts in multiple countries.

We built it because getting a bank account abroad is difficult, time-consuming and expensive. And that’s a problem for expats, freelancers and people who live and work in more than one country. It’s also a problem for international businesses.

You can get:

These are your personal bank details. You can give them to friends, family, companies or clients in the UK, Europe, US, Australia, New Zealand and Singapore to get paid in local currencies, directly into your Wise account. It'd be a local bank transfer for your sender so it's free for you to receive money with these bank details.

You can set it up quickly and easily online.

For businesses, it costs a one-time set up fee of 3,000 JPY. Once you're set up, you can receive money in your account for free.

You can receive money for free in 6 currencies, hold and manage money in more than 50 currencies. See this for the full list of supported currencies.

Switch between currencies effortlessly with a small, transparent fee. There are no set-up fees or monthly charges. And it costs you nothing to receive payments.

Once you’ve opened your balance, you can top up your multi-currency account to convert currencies and send money. If you’re topping up your account using JPY, this is capped at 1 million JPY per top up.

You can receive money into your 6 local bank details for free in AUD, NZD, GBP, USD, EUR and SGD. We currently don’t offer JPY account details.

You can withdraw JPY from your Wise multi-currency account by sending money from your balance to your local Japan bank account. This is capped at 1 million JPY per transfer.

Due to local regulations, if you’re sending money using balances in your multi-currency account, the target amount you can send will be capped at 1 million JPY or equivalent in the target currency. For instance, if you’re sending 10,000 GBP (1.37M JPY) to a recipient in the UK and wish to fund the transfer using your balance, you’d need to perform two separate transfers to your recipients.

We're working on a multi-currency debit card for Japan residents. With this card, you can spend in any currency worldwide at the real exchange rate. To get early access to this card, join our wishlist now.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Here are our top tips and potential pitfalls when sending money from China* using Wise. This service is provided in partnership with a third party payment...

We're excited to announce that Wise is launching a transfer service to help expats to send money from China.* Wise now supports Chinese Yuan (CNY) transfers...

Hi Affiliates, Since we last updated this page, Wise has undergone some changes. We’re no longer called TransferWise, and have undergone a rebrand -...

Wise has revealed a complete visual makeover, featuring a fresh green palette Our new look and feel features a bold new font, imagery and universal symbols ...

Today, we’re introducing big changes to the way Wise shows up to the world. It’s inspired by what makes us different: you. The people who shape us today — our...

10 million people and businesses gained access fast, cheap international payments powered by Wise in 2022 The new year is in full swing - resolutions are in...